Industry News

If You Had Bought Marfrig Global Foods BVMFMRFG3 Shares Five Years Ago Youd Have Earned 199 Returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Marfrig Global Foods S.A. (BVMF:MRFG3) which saw its share price drive 199% higher over five years. Also pleasing for shareholders was the 28% gain in the last three months. But this could be related to the strong market, which is up 11% in the last three months.

Check out our latest analysis for Marfrig Global Foods

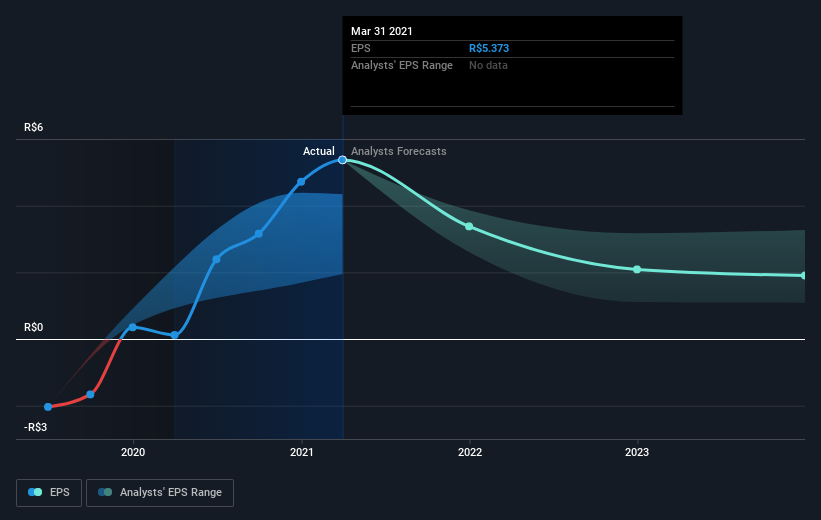

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Marfrig Global Foods moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Marfrig Global Foods has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Marfrig Global Foods' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Marfrig Global Foods' TSR of 202% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Marfrig Global Foods shareholders have received returns of 42% over twelve months, which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 25%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Marfrig Global Foods (1 is a bit concerning!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

Promoted

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020